CWS Market Review – May 10, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Yesterday, for the first time ever, the nominal price of the Advisor Shares Focused Equity ETF (CWS) closed above the nominal price of the Ark Innovation ETF (ARKK). The former is the ETF that’s based on our Buy List and the latter is the popular ETF run by Cathie Wood.

That’s a massive change of course in a short amount of time. Fifteen months ago, each share of ARKK was going for about four times each share of CWS. Now we’re slightly more.

I don’t point this out to gloat. I’m a fan and admirer of Wood’s. Rather, I do this to show the incredible dynamics underlying the current stock market.

Don’t Mistake Rotation for Brains

Wood’s style of investing is what’s called “factor riding.” She invested in nearly every high momentum stock and held on during a period when those stocks were very popular. Shares of ARKK exploded higher (the red line in the chart above).

That’s the easy part of factor riding. The problem is when the market turns against you. If your factor is out of style, the market can be merciless as it has been recently. Whenever you hear of easy and quick gains in the stock market, you can usually assume that the person is somehow engaged in factor riding.

Meanwhile, our style of investing is far more conservative and diversified. That’s why we lagged ARKK before and are leading it now.

So much of Wall Street is governed by which sectors are hot and which are not. Too often, investors mistake simple rotations for brains. Wall Street loves to jump from one shiny plaything to the next; “to everything there is a season.”

Yesterday was a terrible day for the stock market, and that came on top of a dismal market. In last week’s issue, I mentioned that the S&P 500 is off to its worst start for the year in 83 years. For the third time in seven sessions, the S&P 500 fell by more than 3%. On Monday, the S&P 500 closed below 4,000 for the first time since March 2021. We closed a hair above it today.

The S&P 500 peaked on January 3, the first trading day of the year. Official bear markets are typically defined as drawdowns of 20% or more. That means we’ve hit bear territory if the S&P 500 closes below 3,837.25. Today’s low was 3,969.07. Hold on, because we may test the bear level soon.

As bad as the S&P 500 has been, the Nasdaq has been doing even worse. The Nasdaq Composite fell 4.29% on Monday. By the closing bell, the index was down 27.61% from its November high close. The Nasdaq is already in a bear market.

Investors need to understand that the market’s rotation is largely related to the Fed’s interest-rate policy. As the Fed has raised rates in response to inflation, the riskier areas of the market have been severely punished. Meanwhile the more conservative sectors are down, but not nearly as much.

Here’s an update to a chart I ran last week of the S&P 500 Growth versus S&P 500 Value ETFs. You can see just how badly growth stocks have lagged.

Here’s another chart that I think shows a lot. This is the Nasdaq Composite compared with bitcoin.

The correlation isn’t super high, but there’s something there.

Why is this important? That’s because it shows how the market is treating all risky assets, even fairly disparate ones, as if they’re nearly the same. It’s as if the market is placing everything in one of two boxes. One is labeled “risky stuff” and the other is “everything else.”

Everything else is winning.

Last Wednesday, not long after I sent you last week’s issue, the Federal Reserve raised interest rates by 0.5%. There was no surprise there, and the market briefly rallied. On Friday, the market gave it another think and decided it wasn’t happy.

Markets don’t like higher rates. Even though rates aren’t that high yet, the impact is being felt. This is probably the first in a string of 0.5% rate increases. For a time, the market had been expecting a 0.75% increase at the June meeting. However, Fed Chairman Jerome Powell said that the Fed hasn’t been discussing a rate hike that large.

Nearly everything that happens in the stock market is a shadow of what’s going on with interest rates. That’s why the bond and currency markets are adjusting as well. The U.S. Dollar Index recently reached a 20-year high. As always, capital goes where it’s treated best. The yield on the 10-year Treasury recently closed above 3%. Both the 5- and 7-year have as well.

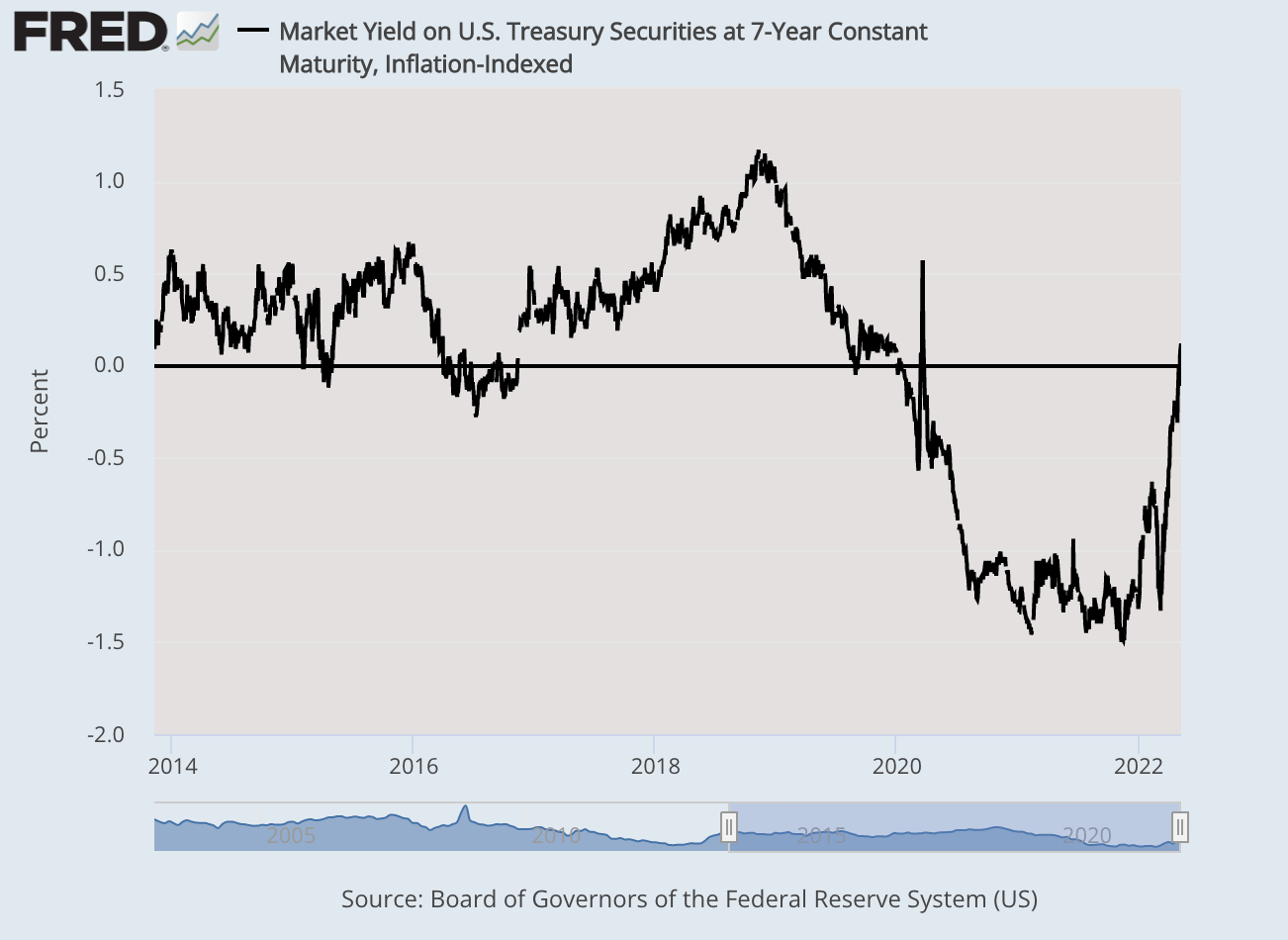

Here’s something interesting: The yield on the 7-year TIPs finally closed above 0%. These are Treasury Inflation-Protected securities which means the return is adjusted for inflation. Two months ago, the same yield was going for -1.33%. The message is that everyone is expecting higher rates. As long as there’s inflation, we’re going to see rates under pressure.

Speaking of which, the next inflation report comes out tomorrow, and it’s been inflation that’s finally woken the Fed up to the damage that it has done. I expect to see another report showing high inflation, although it’s possible that the core inflation number may come in light. The sad fact is that the Fed doesn’t have a good track record of fighting inflation without causing a recession. That’s why so many traders are on edge.

By the way, May panics aren’t unheard of on Wall Street. The Panic of 1837 lasted from May 8 to May 12. Back then, things got so out of hand that at one point, the New York militia had to be called to Wall Street. The effects of the panic didn’t subside for another seven years.

The Panic of 1893 started on May 1 and lasted until May 5. That year, over 600 banks went under. There wasn’t any relief until gold was discovered in the Klondike. In other words, the money supply increased.

While it wasn’t a traditional panic, 82 years ago today was probably the most important day of the 20th century. Germany invaded France, Chamberlain resigned, and Winston Churchill became prime minister. That day the Dow fell 3.4 points, or 2.3%. From May 9 to May 21, the Dow lost 23%.

During all those panics, the selling fervor eventually subsided; it just took time. The same will happen this time. One of my favorite market quotes is from Shelby Cullom Davis: “You make most of your money in a bear market; you just don’t realize it at the time.”

Trex Beats the Street

Investors tend to talk about their big winners and ignore their losers. Well today I want to talk about my biggest loser this year, and that’s Trex (TREX), the deck company.

Through Tuesday, Trex is down by more than half. If Trex magically jumped 50% tomorrow, it would still be our worst-performing stock this year.

Why am I talking about my disaster with this stock? That’s because I still like it. In fact, I think it’s going for a very good value right now.

It’s no mystery why Trex is down so much. It’s being lumped in with the housing market and the market is worried about higher mortgage rates wrecking Trex’s business.

For now, the evidence is that business is going very well. On Monday, Trex released a very good earnings report. (No, they weren’t beating lowered guidance. That’s a favorite trick on Wall Street.) The deck company reported Q1 earnings of 62 cents per share. That’s an increase of 48% over last year, and it was eight cents higher than expectations.

Quarterly sales rose 38% to $339 million. That was above the company’s own guidance of $320 to $330 million.

The CEO said:

“2022 is off to a strong start with Trex Residential posting 40% revenue growth, reflecting a double-digit increase in volume from strong secular trends, as homeowners continue to invest in existing residences and pursue renovations that enhance their outdoor living spaces. Price increases to address inflationary pressures were absorbed by the market and also benefitted net sales. As the category leader with newly expanded capacity, we believe that Trex is capturing more than its share of the ongoing conversion from wood to composite products,” said Bryan Fairbanks, President and CEO.

For Q2, Trex expects sales to range between $375 million to $385 million. At the midpoint, that’s an increase of 22%. For all of 2022, Trex expects double-digit revenue growth.

Trex rose more than 5% today. I can’t say that the rout in the stock is over, but the stock is down and business is going well. The market can’t ignore that forever. It’s not easy to stick with a stock that’s caused so much pain, but investing isn’t about emotions. I’m standing by Trex. By the way, if you want to know more about our Buy List stocks and what I think about them please sign up for our premium Substack. We just had a great earnings season.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. You can get more info on our ETF here.